The private investment market is gaining attention from sophisticated investors due to its potential to outperform public stock and bond markets. It provides access to a significantly larger number of companies with annual revenues of $100M+ compared to public markets (according to Hamilton Lane). However, the selectivity of private investment managers is often overlooked, leading to subpar investment experiences.

The private investment market grants access to privately owned companies not listed on public exchanges, covering various asset classes such as stocks (private equity), bonds (private credit), and real assets (private real estate and infrastructure). Eligibility to participate in the private investment market varies, and there are liquidity, tax reporting, and performance reporting nuances. More traditional investment vehicles (such as mutual funds or exchange-traded funds) offer improved eligibility and liquidity, along with straightforward tax reporting and daily pricing.

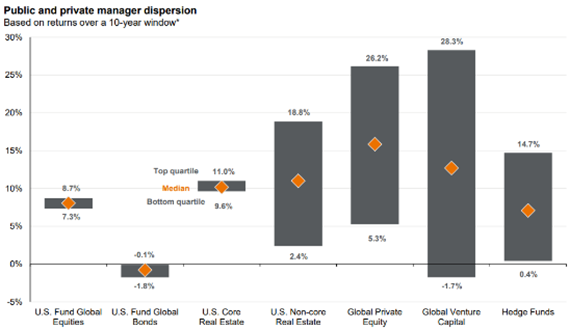

One notable characteristic of the private investment market is its track record of outperforming the public investment market, at times. Over a period from 2018 to 2022, private equity significantly outperformed public equity, with a growth of approximately $2.24 compared to $1.23 per $1 invested (according to Hamilton Lane and Cobalt). From 2000 to 2022, more than 50% of private equity investment managers consistently outperformed their public equity counterparts (according to Hamilton Lane and Bloomberg). While the private investment market offers higher growth potential, not all investors have positive experiences due to the wide performance disparity among private investment managers (as shown below according to J.P. Morgan Asset Management).

To navigate the complexities of the private investment market, careful consideration is required. Factors such as access to proven managers, thorough due diligence, manager alignment with investors, investment strategy philosophy adherence across varying market environments, fund deployment, tax considerations, investor liquidity, and portfolio sizing should be prudently vetted. For example, an investor that is currently subject to estate tax may benefit from positioning a private investment manager within a specific entity to provide for growth outside of their taxable estate. Our team can assist in understanding these details and determining suitable strategies for your investment portfolio. Contact us for more information on this topic and our investment philosophy.

Waldron Private Wealth (“Company”) is an SEC registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. Company may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. For information about the Firm’s registration status and business operations, please consult Waldron’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

This material is for informational purposes only and is not intended to be an offer, recommendation or solicitation to purchase or sell any security or product or to employ a specific investment strategy. Due to various factors, including changing market conditions, aforementioned information may no longer be reflective of current position(s) and/or recommendation(s). Moreover, no client or prospective client should assume that any such discussion serves as the receipt of, or a substitute for, personalized advice from Company, or from any other investment professional. Investing involves risk, including the potential loss of money invested. Past performance does not guarantee future results. Asset allocation and diversification do not guarantee a profit or protect against loss. Company is neither an attorney nor an accountant, and no portion of the web site content should be interpreted as legal, accounting or tax advice.