While we highlight aspects of wealth management that other firms tend to overlook, our investment expertise remains a critically important aspect of our advice. To that end, we operate an institutional-grade investment management approach that we customize precisely to your situation. The result is portfolio recommendations based on strategic and tactical asset allocation and prudent diversification.

Asset Allocation

When evaluating current and recommended holdings—stocks, bonds, cash, real estate, alternatives and other investment vehicles—asset allocation may be the most important part of the investment decision. We advise on investments to provide a high level of diversification, but whatever we consider, we are always guided by this maxim—“Know what you’re paying for; never invest in something you don’t understand or is difficult to value.” Once investments are made, we regularly summarize and report on your assets by entity, by category, and by manager.

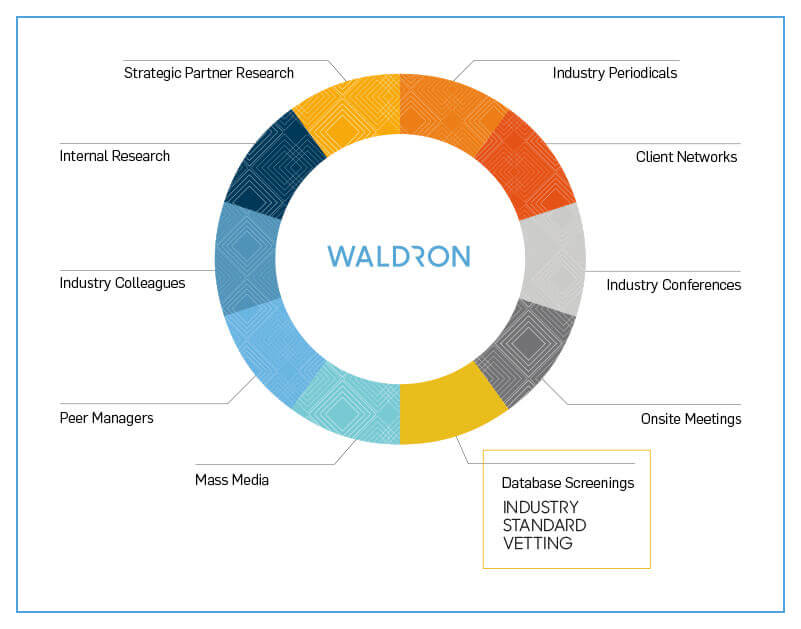

Manager Selection and Monitoring

Starting with managers who have demonstrated a history of consistent performance, we dig deeper, using in-depth interviews to understand the rationale behind a manager’s performance. They are considered through the lens of both rate of return and risk taken to achieve that return. We then carefully monitor the chosen managers, replacing them with more suitable candidates if necessary.

Performance Reporting

Reporting can be produced in accordance with your needs and within the context of your goals and objectives. It can be structured for you or your family office.

Concentrated Stock Position Management

Maybe you received a large block of stock as part of executive compensation, or maybe an early investment in a single stock historically provided above-average returns, or maybe it is a family legacy passed down to you, it is still best to diversify—but when, and at what pace? We’ll provide the answers.

Review and Reporting of Non-managed Accounts

So you see the total picture, our reporting technology is built around pulling together the detailed transactions and values for all your investment accounts. We then perform the aggregation of data needed to clearly evaluate non-managed accounts and place them within the proper context of your portfolio.

Private Equity Tracking

Despite the nature of private equity investments—large and illiquid for long periods—they should be tracked continually as part of your overarching strategy.

After Tax Return Analysis

A performance figure for an investment doesn’t tell the whole story. What was the true return after taxes? By viewing your investments through the lens of your tax situation, we make sure the recommendations remain true to your overall plan.

Investment Location Structuring

Hand in hand with asset allocation is the location of investments—should the investment be in an exempt or non-exempt generation skipped trust? An IRA? The 360° view Waldron provides leads to the decisions that can ultimately be of great benefit to our clients.